If for some reason your trip is extended and your flight is. This Determination sets out the amounts that the Commissioner considers are reasonable reasonable amounts for the substantiation exception in Subdivision 900-B of the Income Tax Assessment Act 1997 ITAA 1997 for the 2021-22 income year in relation to claims made by employees for.

A perfect travel insurance plan will assist you with any emergencies that you may face while travelling.

. Some of these are. A tax relief of up to a maximum of 19 percent of the following deductible expenses is allowed only to resident taxpayers. Unlock the power of one of the worlds most connected hospitality platforms.

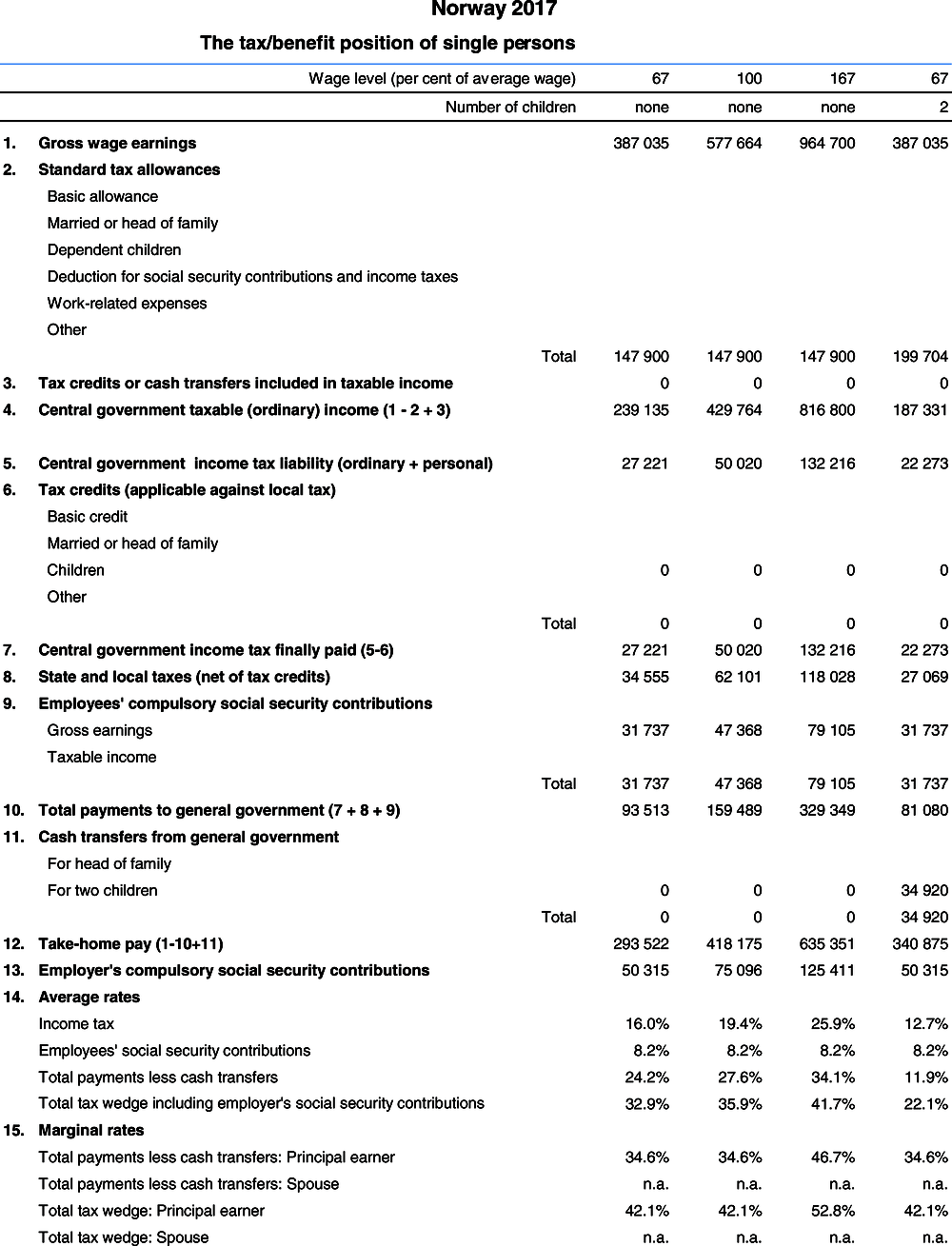

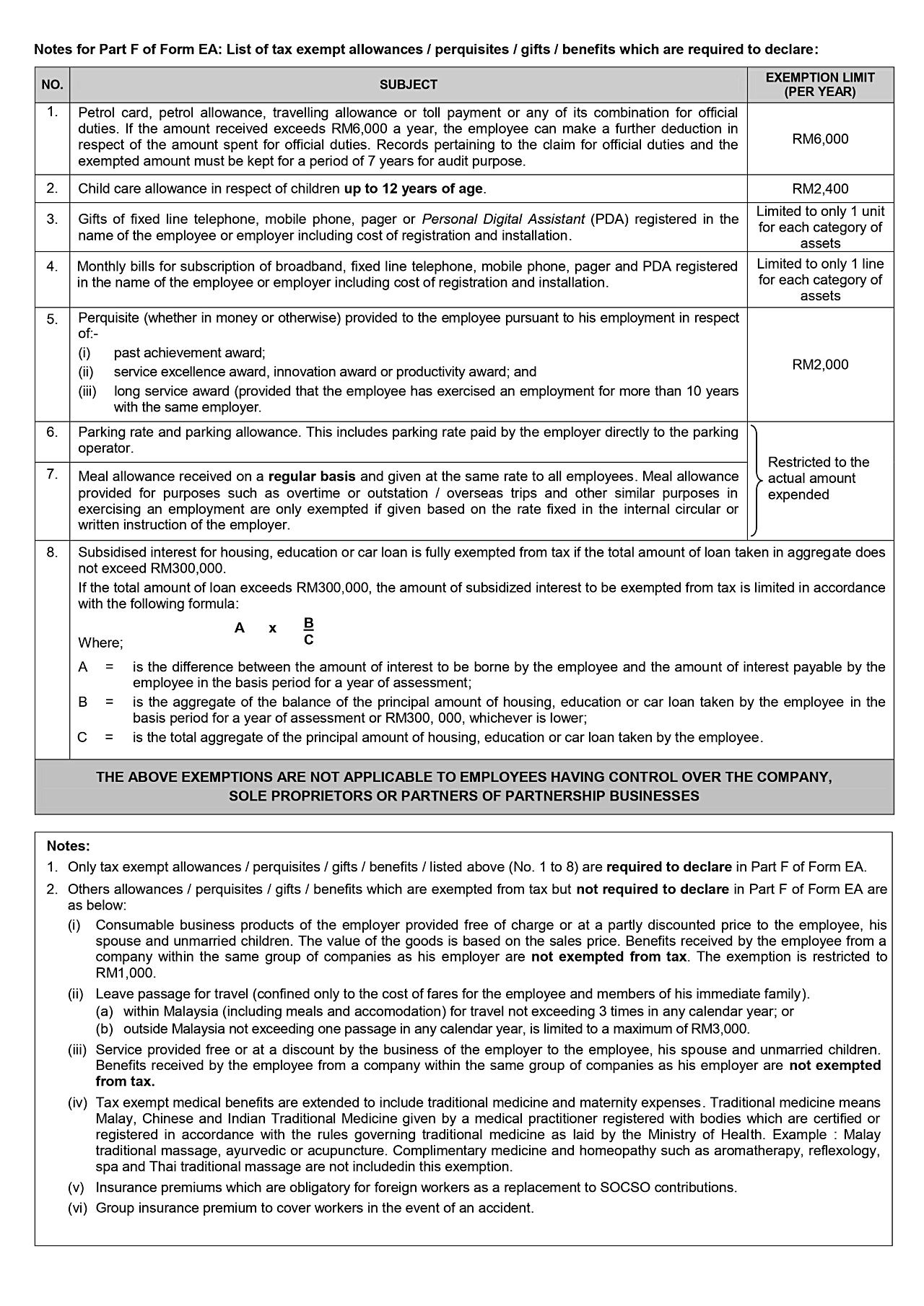

Definitions of certain terms relevant to income from profits and gains of business or profession. What this Determination is about. F20 Domestic tourism expenses 24 - Tax schedule for year of assessment 2021 26 EXPLANATORY NOTES be 2021 RESIDENT DOES NOT CARRY ON BUSINESS - 1 - provision of section 7 of Income Tax Act 1967 ITA 1967 or In the case of a married individual who elects for joint assessment either in the name of husband or wife and a citizen worker holding key.

Knowing what expenses are not tax deductible might help company to minimise such expenses. However an unfortunate incident can cause irreversible damage which can drain your income in just a fraction of. Expenses related to the transfer of mortal remains to home country should the policyholder die of COVID-19.

A mandatory out-of-pocket expense required by an insurance policy before an insurer will pay a claim is called a deductible or if required by a health insurance policy a copayment. The insurer may hedge its own risk by taking out reinsurance whereby another insurance company agrees to carry some of the risks especially if the primary insurer deems the risk too large for it to carry. Expenses or payments not deductible in certain circumstances.

Profits chargeable to tax. Dividends are tax free as long as the money is only brought into thailand after 1 year. Overtime meal expenses -.

New city or new country. Expenses that are not incurred. Certain expenses have often been refused a tax deduction even though for businessman they are regarded as necessary business costs.

Your travel insurance plan will provide you with every urgent assistance ranging from legal help to steps to get your duplicate passport. Treatment can be offered on a cashless basis in network hospitals. RMS has over 550 integrated partners Build your perfect tech stack.

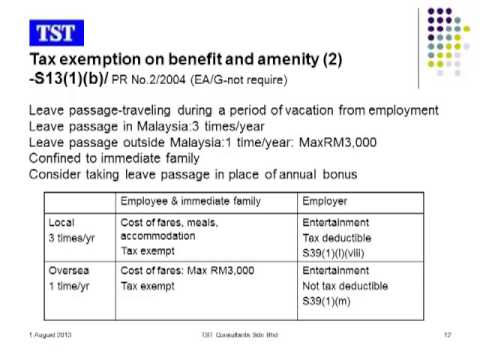

So if youre the super safe type of person just make sure that dividend is paid by from the company to your personal UK bank account rather than direct to your Thai bank account and dont bring those particular into Thailand for at least one year. Hospitalisation expenses if the policyholder catches COVID-19 under this overseas travel insurance. Assuming per trip is RM10000 and three times per year is RM30000 this RM30000 will be exempted and does not have to go in to your EA form.

So from the companys point of view its deductible. Income tax means income tax imposed as such by this Act as assessed under this Act but does not include dividend withholding tax or salary or wages tax and includes specific gains tax. Buying a home is a milestone achievement for most people in our nation where people invest their years of income to buy a residential property.

A-Plus Health Booster provides worldwide coverage. The following are more common non-allowable expenses. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

A home insurance policy will avoid loss of financial expenses due to unforeseen circumstances like flood theft fire etc. Its under the so-called Staff Benefit and Amenity so its deductible for tax purposes for company accounting. Medical expenses incurred are also covered on a reimbursement basis.

Medical expenses exceeding EUR12911 in any year incurred by the taxpayer their spouse and other dependents including those charged by specialists. However if you are residing or travelling outside of Malaysia for more than 90 consecutive days you will not be covered for any medical treatment received. Special provision for deductions in the case of business for prospecting etc for mineral oil.

AIA will only pay the eligible medical expenses up to an amount we consider is reasonable and customary provided that the medical care is medically necessary. 13 joint venture means an enterprise carried on by two or more persons in common otherwise than as a partnership.

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Tax Incentives For Research And Development In Malaysia Acca Global

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Tax Exemption On Leave Passage Vacation For Staff Benefit Youtube

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Special Personal Income Tax Relief Up To Rm 1 000 For Domestic Travels Sunway Travel Sdn Bhd

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Remember To Keep Your Traveling Receipt When Traveling For Personal Income Tax Deduction Rm1000 Everydayonsales Com News

Updated Guide On Donations And Gifts Tax Deductions

Tax Exemption On Leave Passage Vacation For Staff Benefit Kclau Com

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

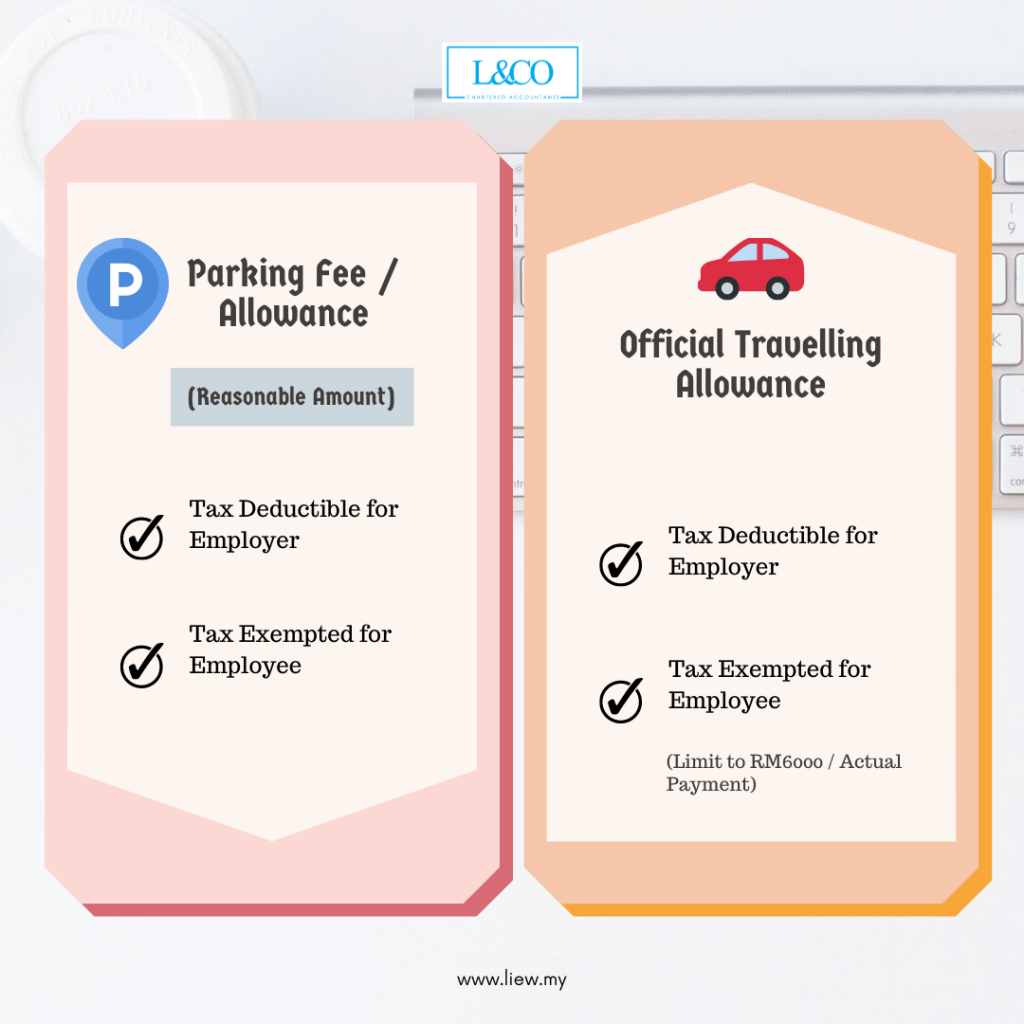

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co